Irs 2024 Form 8995

Irs 2024 Form 8995 - Keeping kids interested can be challenging, especially on busy days. Having a bundle of printable worksheets on hand makes it easier to encourage learning without extra prep or screen time.

Explore a Variety of Irs 2024 Form 8995

Whether you're helping with homework or just want an educational diversion, free printable worksheets are a great tool. They cover everything from math and reading to games and creative tasks for all ages.

Irs 2024 Form 8995

Most worksheets are quick to print and use right away. You don’t need any special supplies—just a printer and a few minutes to set things up. It’s simple, fast, and effective.

With new designs added all the time, you can always find something exciting to try. Just download your favorite worksheets and make learning enjoyable without the stress.

Complete Guide To IRS Form 8995 Reconcile Books

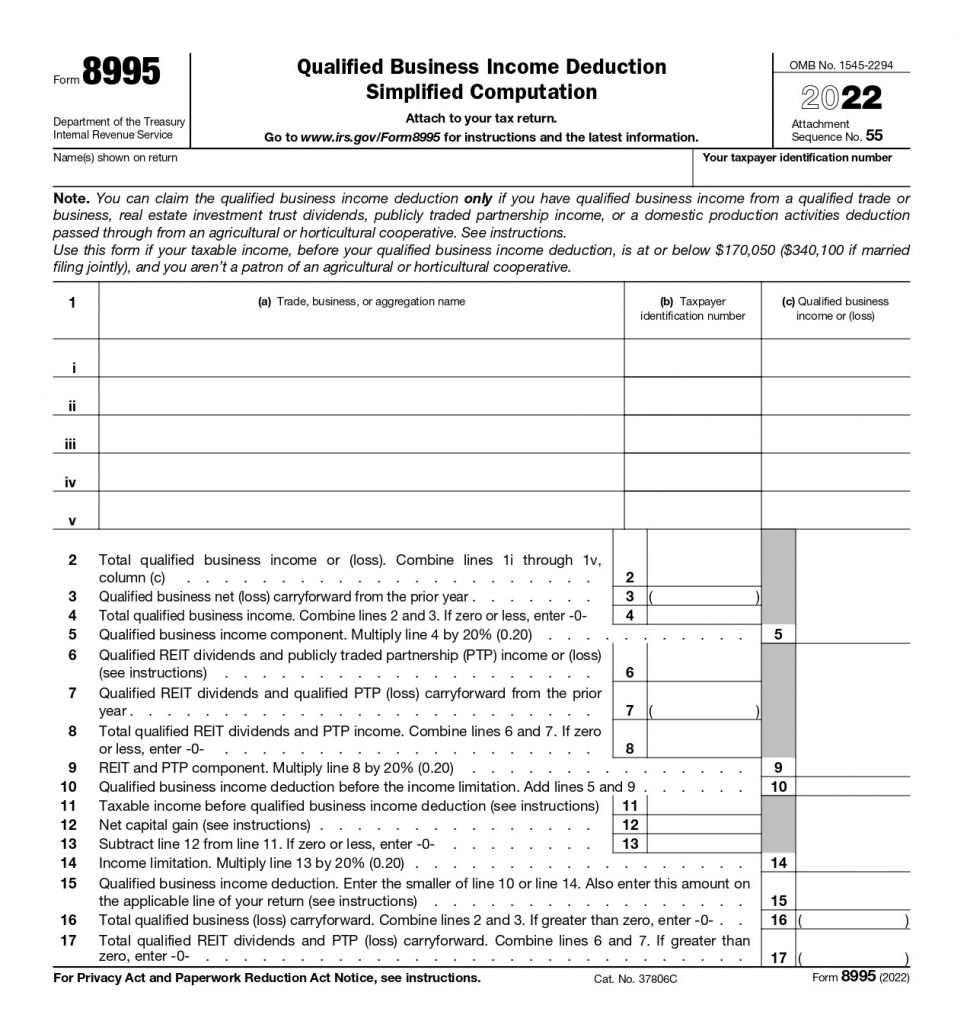

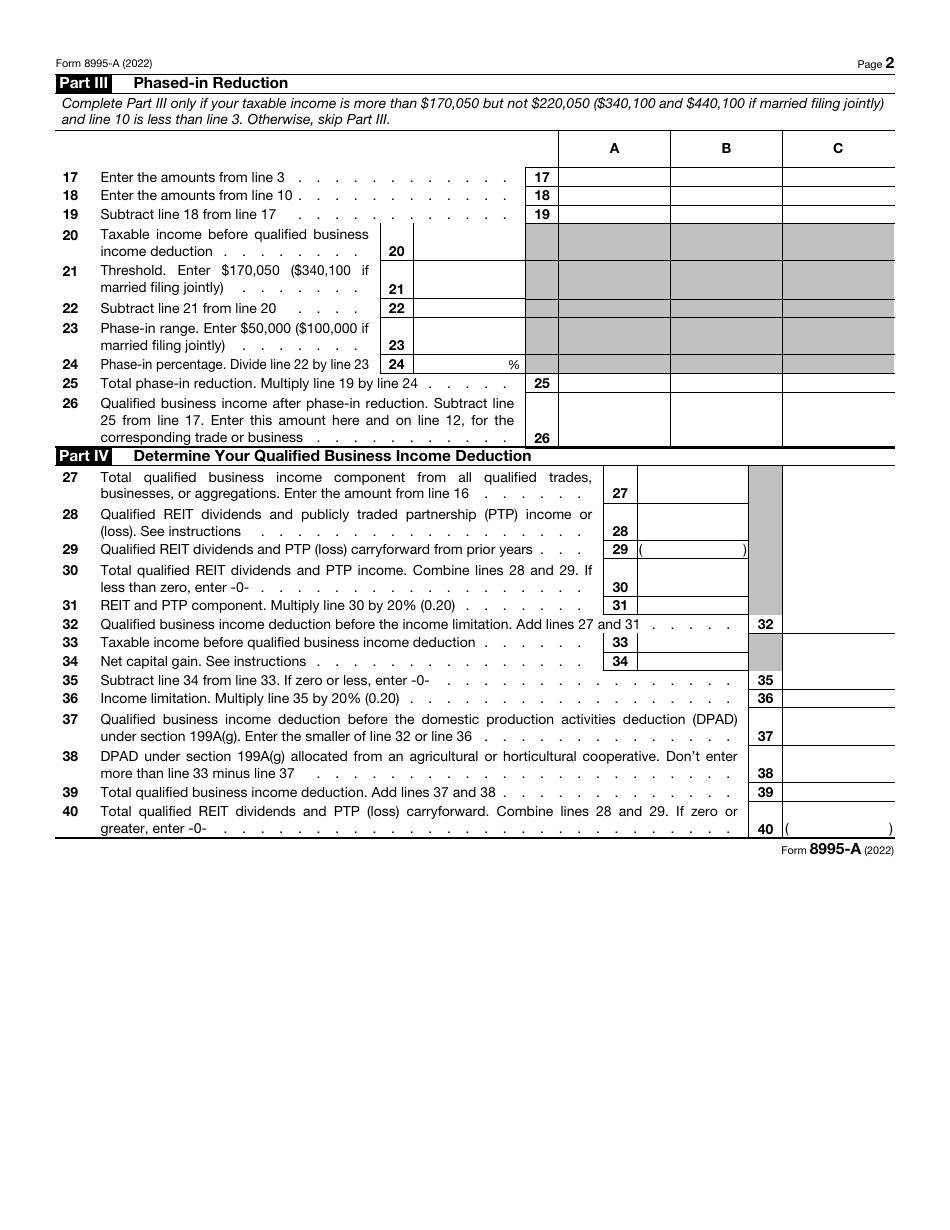

The IRS has released draft instructions to the draft Form 8995 Qualified Business Income Deduction Simplified Computation The Tax Cuts and Jobs Act TCJA created IRC 199A which allows a deduction to non corporate taxpayers including trusts and estates who have qualified business income QBI from a partnership S corporation or sole proprietorship in tax years beginning after Dec Form 8995 is a newly created tax form used to calculate the Qualified Business Income Deduction (QBID). In some circumstances, form 8995-A may be used to calculate this deduction instead. How do I add this form to my return? Form 8995 and the QBID will be automatically generate and calculated based on your income entries.

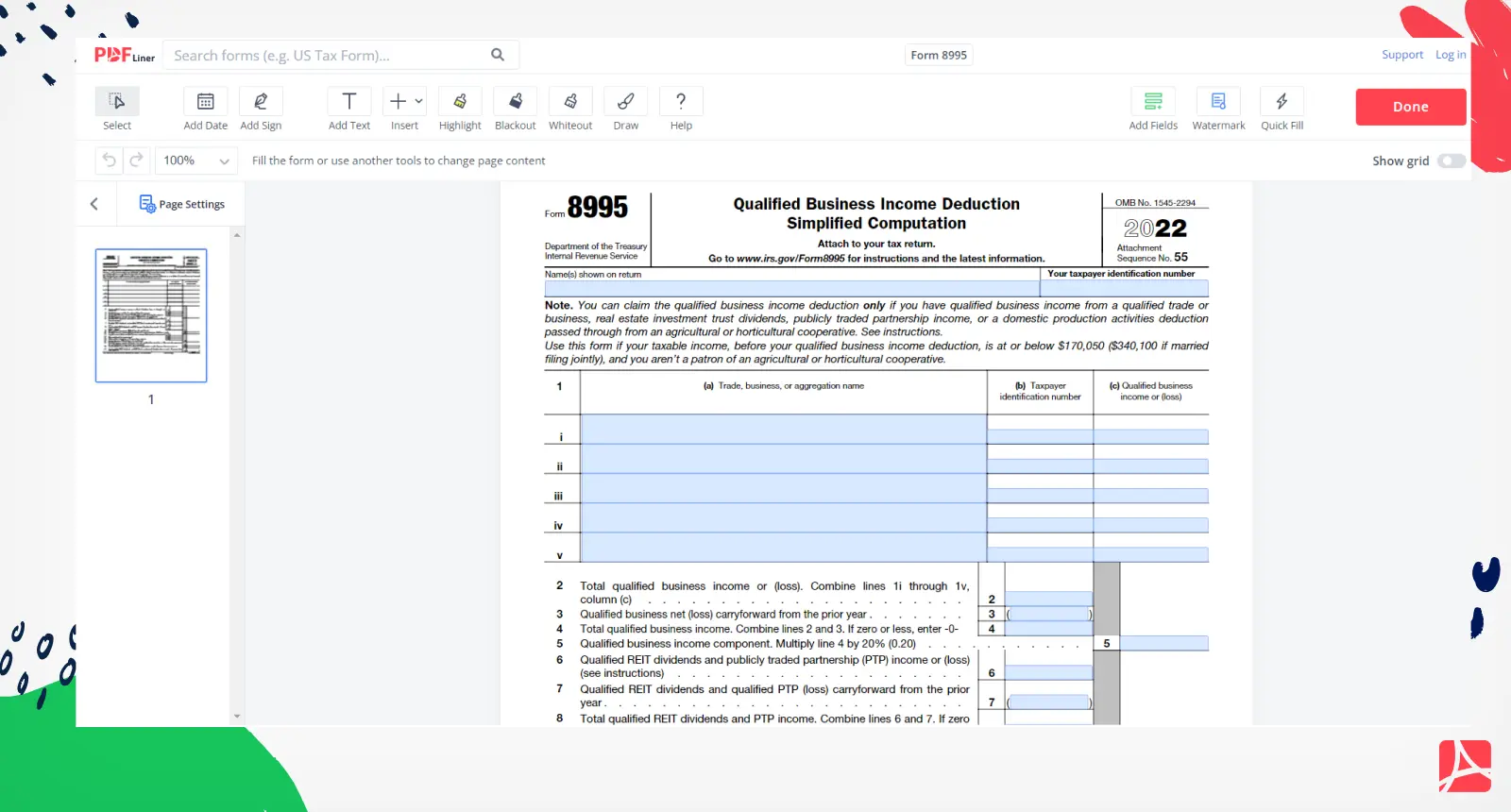

IRS Form 8995 Printable Form 8995 Blank Sign Form Online PDFliner

Irs 2024 Form 8995What is Form 8995? Form 8995 is the IRS tax form that owners of pass-through entities— sole proprietorships, partnerships, LLCs, or S corporations —use to take the qualified business income (QBI) deduction, also known as the pass-through or Section 199A deduction. You can use Form 8995 if your 2023 total taxable income before the qualified business income deduction is less than 182 100 364 200 for joint filers and you re not a patron of an agricultural or horticultural cooperative Otherwise you ll use the longer Form 8995 A The Qualified Business Deduction QBI

Gallery for Irs 2024 Form 8995

Form 8995 Basics Beyond

IRS Form 8995 Instructions For 2022 Download Form 8995 Product For Free

IRS Form 8995 2022 Federal 8995 Tax Form PDF Instructions For Printable Income Sample

Tax Form 8995 2022 IRS 8995 Form PDF Printable Instructions To Fill Out Fillable Sample

IRS Form 8995 Get The Qualified Business Income Deduction

8995 Form IRS Form 8995 For Instructions Printable Sample With PDF Example

IRS Form 8995 A Your Guide To The QBI Deduction

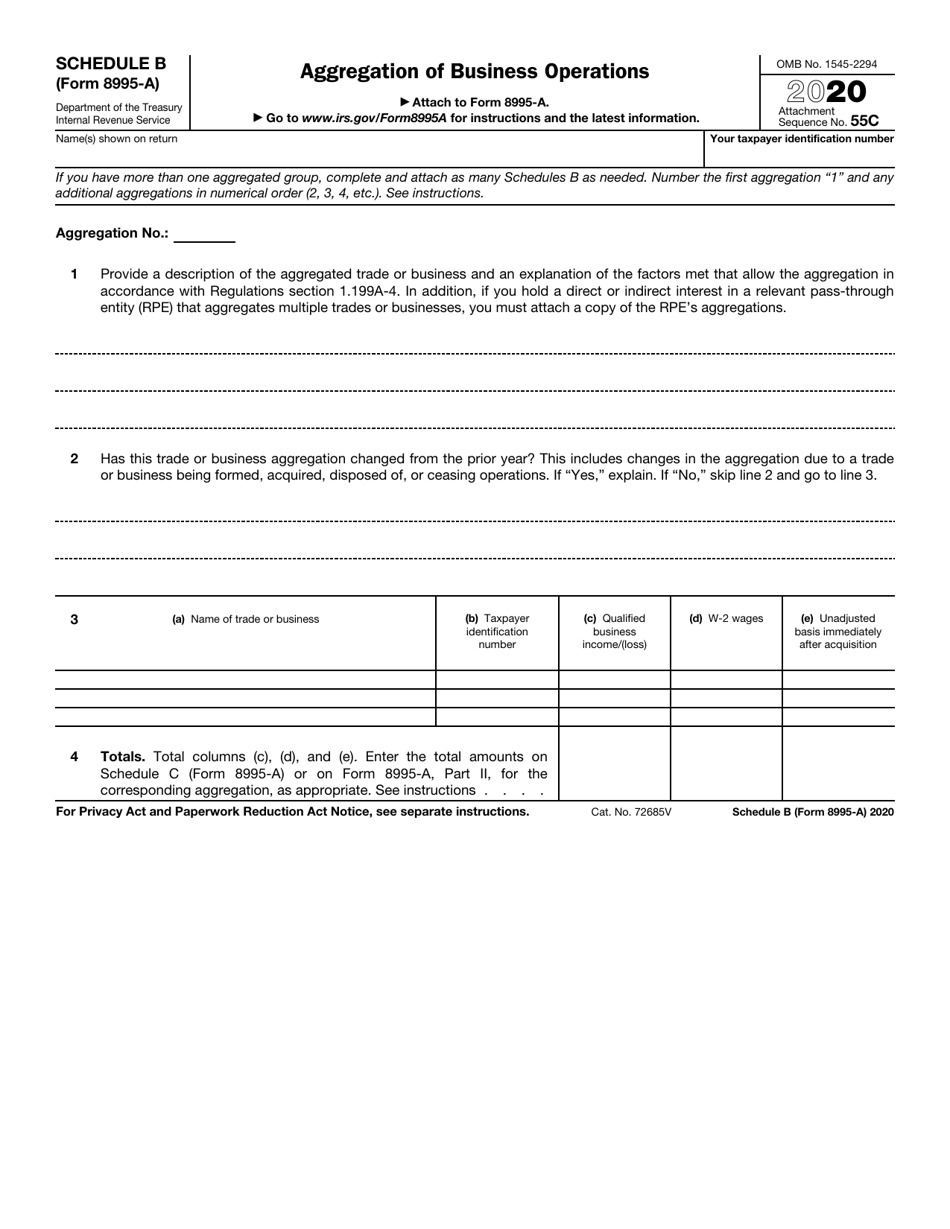

IRS Form 8995 A Schedule B 2020 Fill Out Sign Online And Download Fillable PDF Templateroller

Fillable Online 2020 Instructions For Form 8995 IRS Tax Forms Fax Email Print PdfFiller

IRS Form 8995 A Download Fillable PDF Or Fill Online Qualified Business Income Deduction 2022